Comprehensive Guide to Personal Income Tax in Thailand for Residents, Non-Residents, and Digital Nomads.

Personal Income Tax (PIT) is a direct tax imposed on an individual’s earnings. The term "person" may include individuals, unincorporated partnerships, non-juristic groups, and undivided estates. Generally, those subject to PIT are required to calculate their annual tax liability, submit a tax return, and pay any owed taxes based on the calendar year.

TAXABLE PERSON

Individuals are classified as either residents or non-residents for tax purposes. A resident is someone who has stayed in Thailand for more than 180 days during a calendar year and must report global income that is brought into Thailand. Non-residents are only taxed on income earned within Thailand.

TAX BASE

Personal income tax is applied to “assessable income,” which includes both cash and non-cash compensation, such as employer-paid housing or tax liabilities. This income is categorized into eight types, covering employment income, professional services, property income, dividends, and business profits, among others.

Personal income subject to tax is classified into eight categories, including:

1. Wages or salaries earned through employment.

2. Payments received from performing duties, holding positions, or providing services.

3. Earnings from intangible assets like goodwill, intellectual property, franchises, annuities, or recurring payments received through wills or legal rulings.

4. Investment income, such as dividends, interest from Thai bank deposits, profit shares from companies or mutual funds, returns from capital reduction, bonuses, capital gains from mergers, acquisitions, or share transfers.

5. Rental income from property, or compensation related to contract breaches, installment sales, or hire purchase agreements.

6. Income generated from practicing professional services, such as law, medicine, engineering, or similar fields.

7. Earnings from construction or contractual projects.

8. Profits from business operations in areas like trade, agriculture, manufacturing, transport, or any other unspecified commercial activities.

DEDUCTIONS & ALLOWANCES

Before calculating tax liability, taxpayers are allowed to deduct certain expenses and claim personal allowances.

Taxable income is determined using the formula:

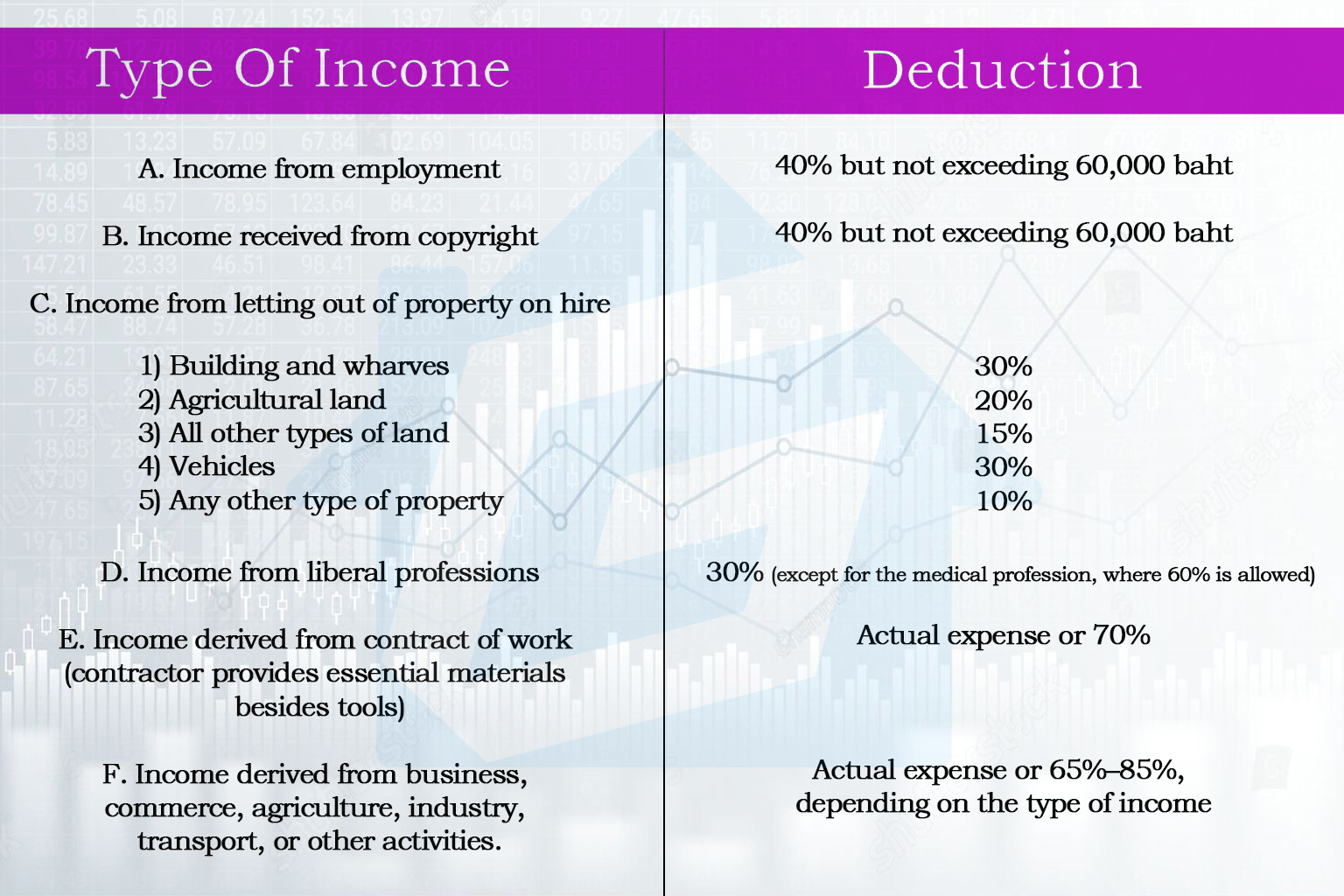

Deductions in Personal Income Tax Calculation

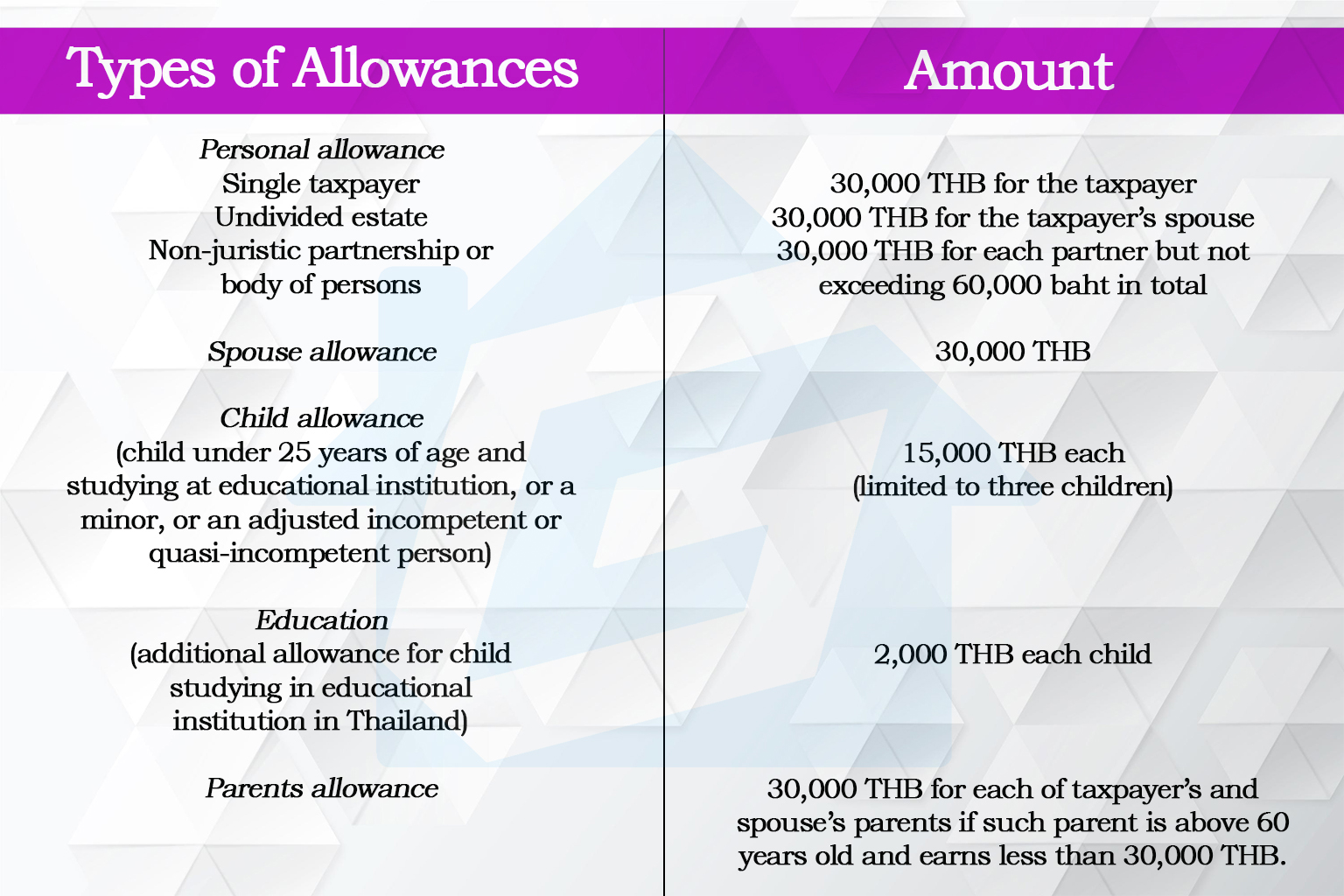

Personal Income Tax Allowances and Exemptions (Part 1)

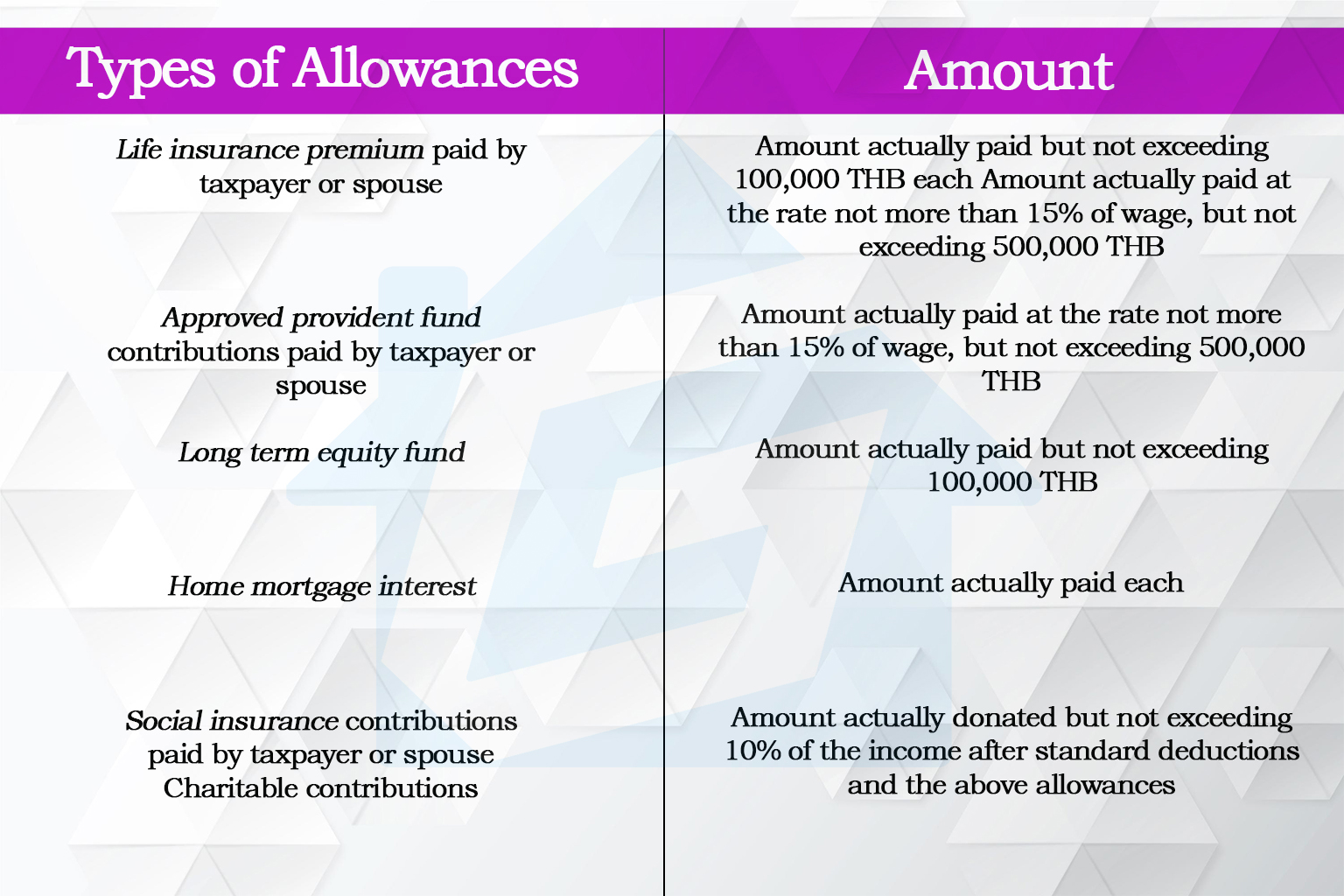

Personal Income Tax Allowances and Exemptions (Part 2)

TAX CREDIT FOR DIVIDENDS

A taxpayer domiciled in the Kingdom of Thailand who receives dividends from a juristic company or partnership incorporated under Thai law shall be entitled to a tax credit equal to three-sevenths (3/7) of the amount of such dividends. For the purpose of computing assessable income, the taxpayer shall gross up the dividends by adding the amount of the tax credit to the dividends received. The tax credit so calculated shall be allowed as a credit against the taxpayer’s personal income tax liability for the relevant tax year.

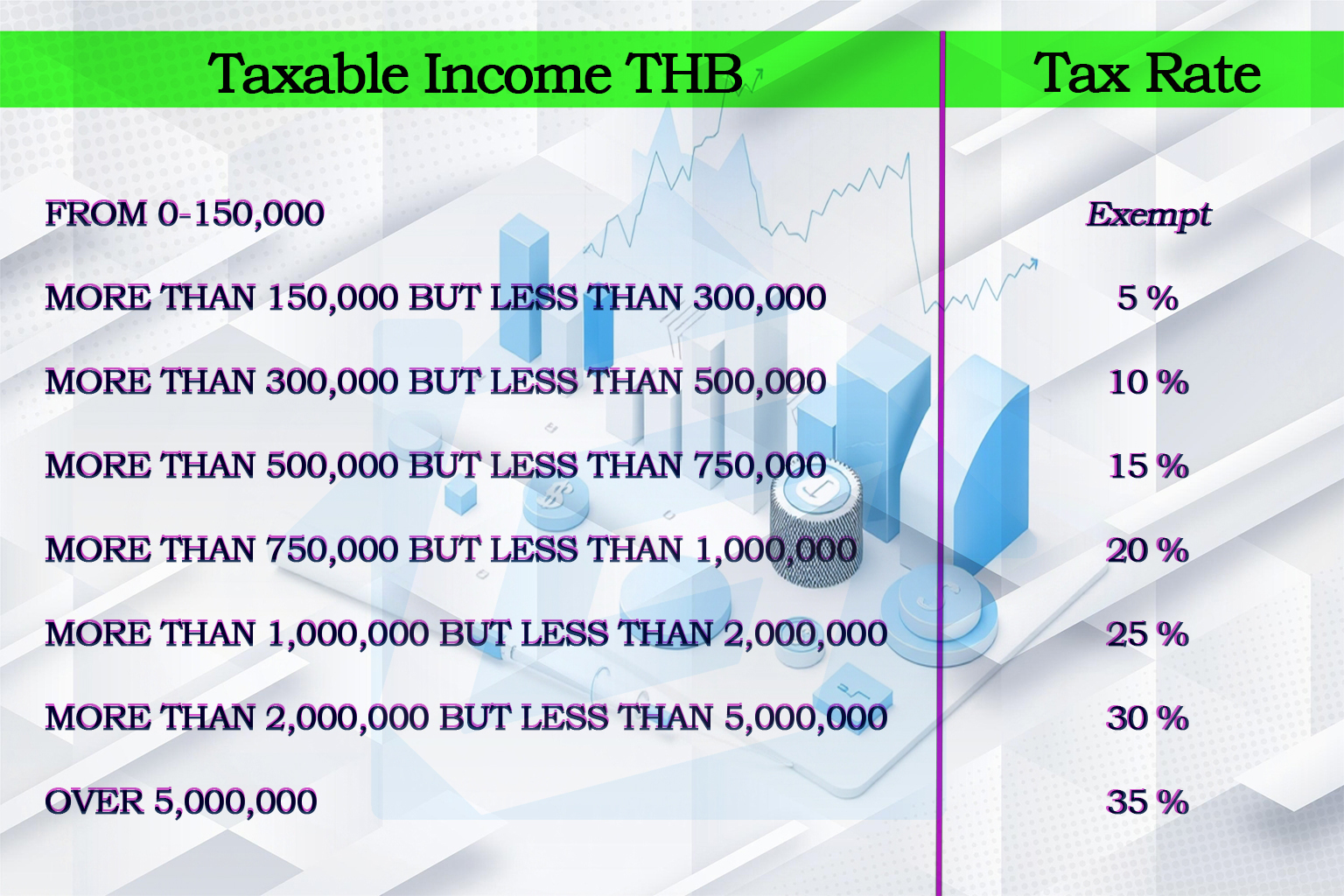

PROGRESSIVE TAX RATES

Personal income tax shall be levied on the taxable income of individuals on a progressive basis, in accordance with the rates and income brackets prescribed under the applicable provisions of the Revenue Code.

INTEREST INCOME

Taxpayers may choose to exclude certain types of interest income from their Personal Income Tax (PIT) calculations, provided a 15% tax is withheld at the source. Eligible interest includes:

1. Interest from government-issued bonds or debentures.

2. Savings account interest from commercial banks, if total interest earned does not exceed 20,000 baht in a tax year.

3. Interest from loans provided by finance companies.

4. Interest received from financial institutions established under specific Thai laws to support sectors such as agriculture, trade, or industry.

DIVIDEND INCOME

Individuals residing in Thailand who receive dividends or profit shares from a registered company or mutual fund, and where a 10% withholding tax has already been applied, may elect to exclude these amounts from their assessable income. However, choosing this option means the taxpayer cannot claim a refund or tax credit for the withheld amount.

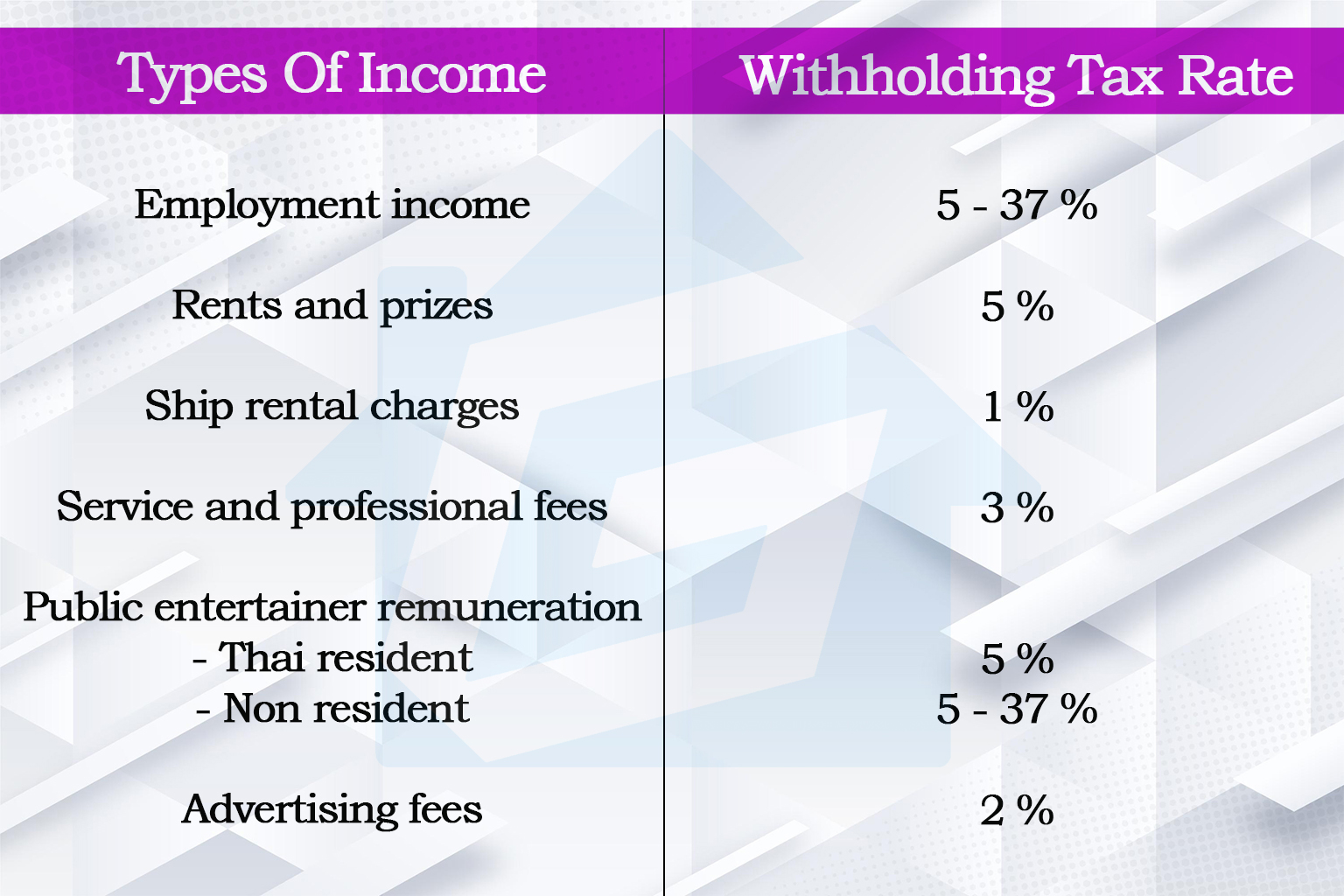

WITHHOLDING TAX

Certain types of income require the payer to withhold tax before making payment. The payer must file the appropriate return (Forms PIT 1, 2, or 3, as applicable) and remit the withheld amount to the District Revenue Office. The withheld tax can later be credited against the taxpayer’s overall PIT liability. Withholding rates vary depending on the type of income received.

TAX OBLIGATIONS IN THAILAND

Filing and Payment Deadlines

Individuals must submit their Personal Income Tax return and settle any tax owed to the Revenue Department by the end of March following the taxable year. Late filing or payment can result in penalties, so it’s advisable to pay promptly. Thailand’s tax year spans from January 1 to December 31, and returns for the prior year must be filed by March 31.

For those earning income through certain professions such as property sales, engineering, architecture, accounting, fine arts, or medical services the tax return must be submitted by September 30, with payment due by June 30 of the following year. Foreign workers should be aware that renewing a work permit typically requires presenting proof of the previous year’s tax filing.

OBTAINING A TAX IDENTIFICATION NUMBER

Foreign residents generating income in Thailand are required to obtain a Tax ID number. This can be requested from the local tax office by providing a valid passport or identification card, along with documentation explaining the need for the number.

DIGITAL NOMADS AND ONLINE WORKERS

Regardless of the type of work whether you’re a programmer, content creator, or other remote professional income earned while living in Thailand is taxable. If you are not paying taxes in your home country, you are generally expected to pay taxes in Thailand.

RESIDENT VS. NON-RESIDENT TAX STATUS

Anyone spending more than 180 days in Thailand during a calendar year is considered a tax resident and must declare global income. Non-residents (those staying fewer than 180 days) are taxed only on income earned within Thailand. Importantly, not having a work permit does not exempt you from tax obligations.

DOUBLE TAX AGREEMENTS

Thailand has signed double taxation treaties with many countries to prevent individuals and businesses from being taxed twice on the same income. These agreements help ensure that income is taxed in only one jurisdiction. For digital nomads, this typically means that if you spend fewer than 180 days in Thailand, only Thai sourced income is taxed locally, while retrospective earnings may still be subject to review.